The "Frozen Market" in Real Estate: Implications for Buyers and Sellers

The real estate market is known for its fluctuations, with periods of booming sales and rapid price increases, followed by times of stagnation. In recent months, there has been growing talk of a "Frozen Market" in the real estate industry, a term used to describe a situation where home sales seem to be at a standstill. Let's delve into what this means for both buyers and sellers.

Understanding the Frozen Market

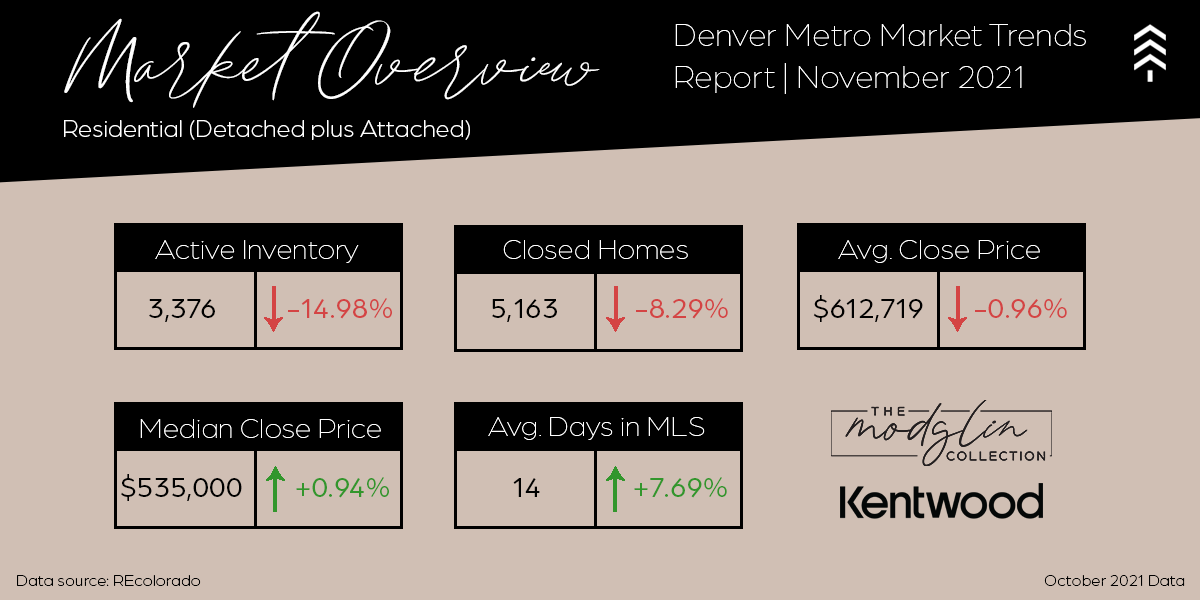

The term "Frozen Market" refers to a slowdown in the pace of existing home sales. This phenomenon often occurs due to a combination of factors, including rising interest rates, supply chain disruptions, and economic uncertainty. One such example is the September 2023 report, as highlighted in a CNN article. These factors can lead to homes spending longer on the market, a decrease in buyer activity, and potentially a leveling off of home prices.

Implications for Buyers

For potential homebuyers, a Frozen Market can present both challenges and opportunities:

More Inventory: As homes stay on the market for a longer duration, there may be more options available to buyers. This can be advantageous for those who are looking for their dream home and have time to explore different listings.

Negotiating Power: With decreased competition, buyers may have more negotiating power when it comes to pricing and contingencies. Sellers may be more willing to compromise in a slower market.

Interest Rates: However, it's important to keep an eye on interest rates, as they can influence the affordability of a home. Rising rates can counterbalance some of the advantages of a Frozen Market, so buyers should lock in favorable rates when possible.

Implications for Sellers

Sellers, on the other hand, may need to adjust their strategies in a Frozen Market:

Price Realism: It's essential for sellers to set realistic listing prices. In a slower market, overpricing can lead to prolonged days on market and potential price reductions, which can be detrimental to the sale.

Home Presentation: To stand out among the competition, sellers should ensure their homes are well-maintained and properly staged. Making a positive first impression is crucial.

Patience: Sellers may need to be patient and prepared for their homes to remain on the market for an extended period. This doesn't necessarily mean they have to accept lower offers, but it does require resilience.

Conclusion

A Frozen Market in real estate can have varying effects on both buyers and sellers, depending on their individual circumstances and the local market conditions. Staying informed about the latest trends and working with experienced real estate professionals can help navigate these challenging times.

In the end, whether you're buying or selling in a Frozen Market, the key is to adapt to the situation and make informed decisions that align with your long-term goals and financial stability.

If you have any questions about how you can navigate through the FROZEN Market, don’t hesitate to reach out. We are here to help!